Let me start by saying that if you’re pro-bitcoin, you’re not in my tribe. And, if you’re anti-bitcoin, you’re not in my tribe. I’m not emotional about these things, so please take the following in that spirit. It is commentary.

Bitcoin had to overcome three primary challenges. The first was infinite possible substitutes. Bitcoin sailed past all of these new cryptocurrency entrants; it’s unlikely that any will rival btc. For good measure, it made some progress towards defeating another substitute, gold. Gold has history on its side—5,000 years’ worth—but bitcoin has notable advantages including zero storage cost, infinite divisibility, and portability.

The second challenge that bitcoin had to overcome was security. So far, so good. There’s an unknown challenge in the future represented by quantum computing, but so far bitcoin is perfectly secure.

The third challenge for bitcoin is opposition from governments.

On X today, Jason Calacanis posted the following:

link: https://x.com/Jason/status/1855707535724175719

It is indeed shocking that states haven’t acted.

The case for states actively seeking to crush btc is fairly straightforward. I’m going to use the US as an example here, but the situation is similar for other Western governments.

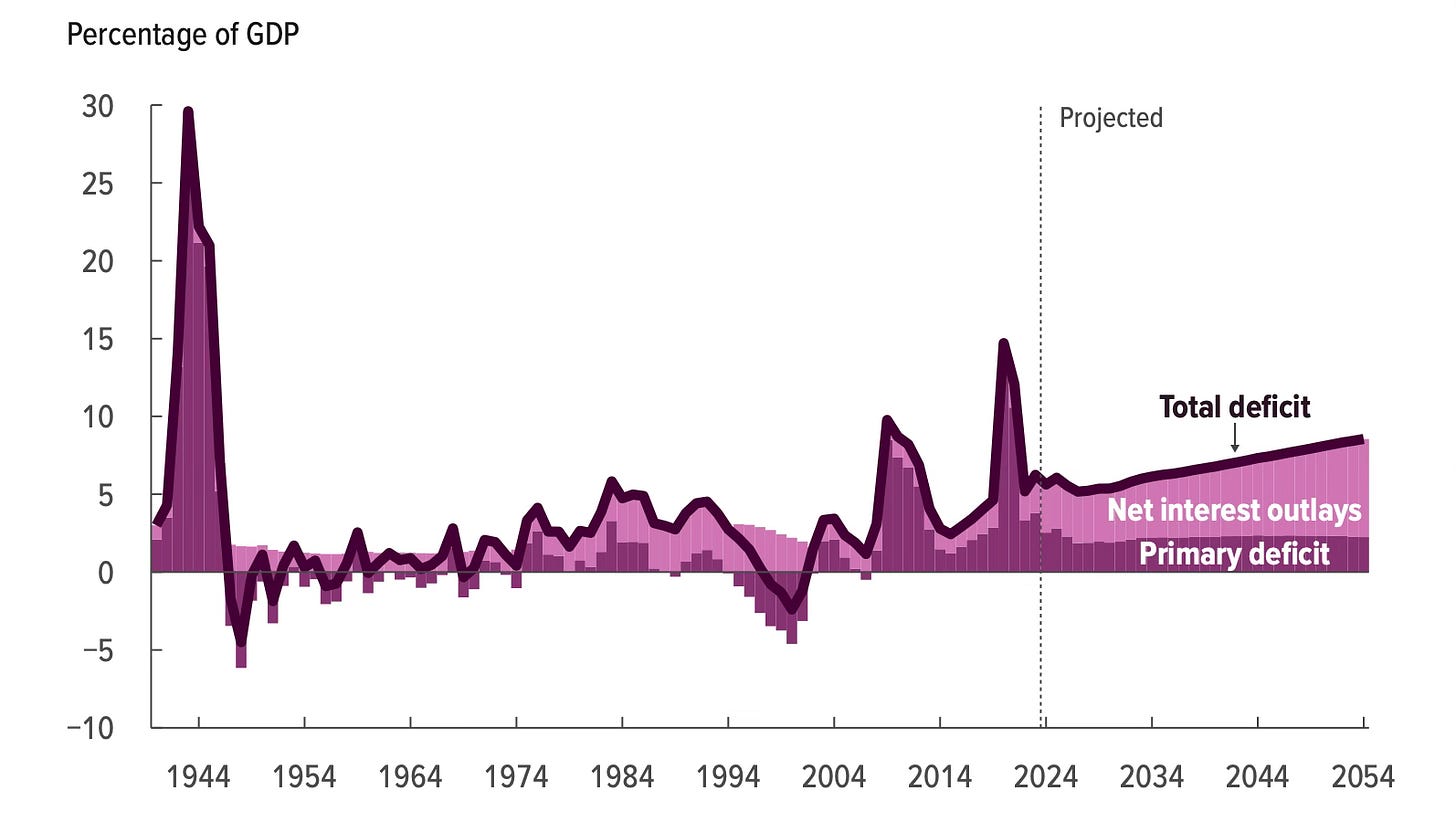

This is the May 2024 Congressional Budget Office long-term budget forecast:

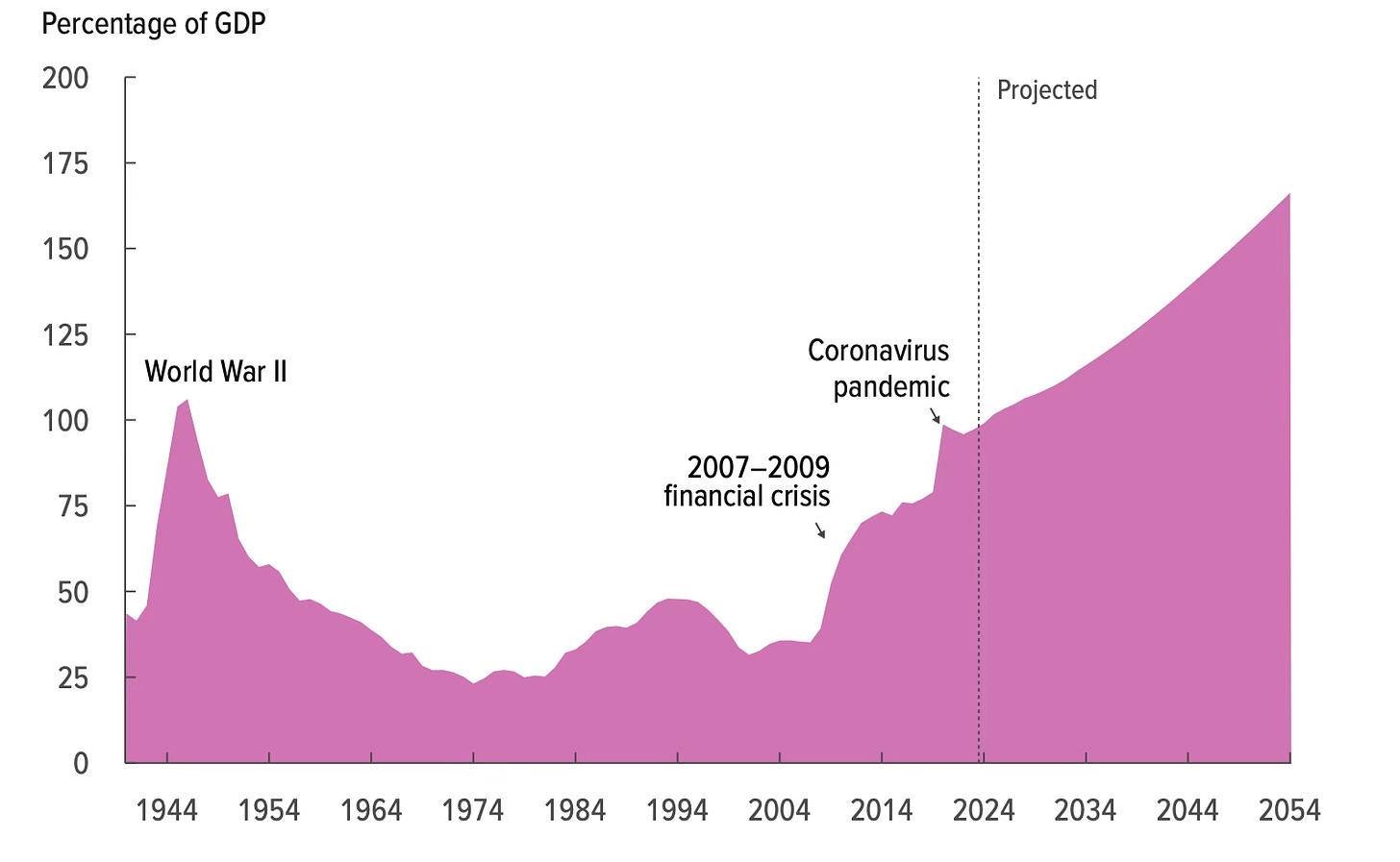

This is how it translates into the US federal debt-to-gdp ratio:

As Jerome Powell pointed out last week, the current level of US federal debt-to-gdp is not a major concern. The trajectory, however, is troubling.

In this newsletter later this week, I’m going to write about Peter Bernholz’s book Monetary Regimes and Inflation. Bernholz argues that the strongest explanatory variable for hyperinflations is the percentage of the budget funded by tax receipts. He finds that there is a tipping point: if a government funds less than 60% of its budget with tax receipts for two years or more, there’s a very high probability of hyperinflation.

Tax receipts in 2023 were 16.5% of GDP in a strong economy. Compare that figure to the CBO deficit projections above. I think that the CBO projections might err towards pessimism in one respect, which is that they don’t assume a productivity blast from AI and robotics. They can’t really, because the history is that rapid technological change mostly doesn’t translate into big changes in the growth rate of GDP per capita. It’s probably different this time, but they can’t assume that it is.

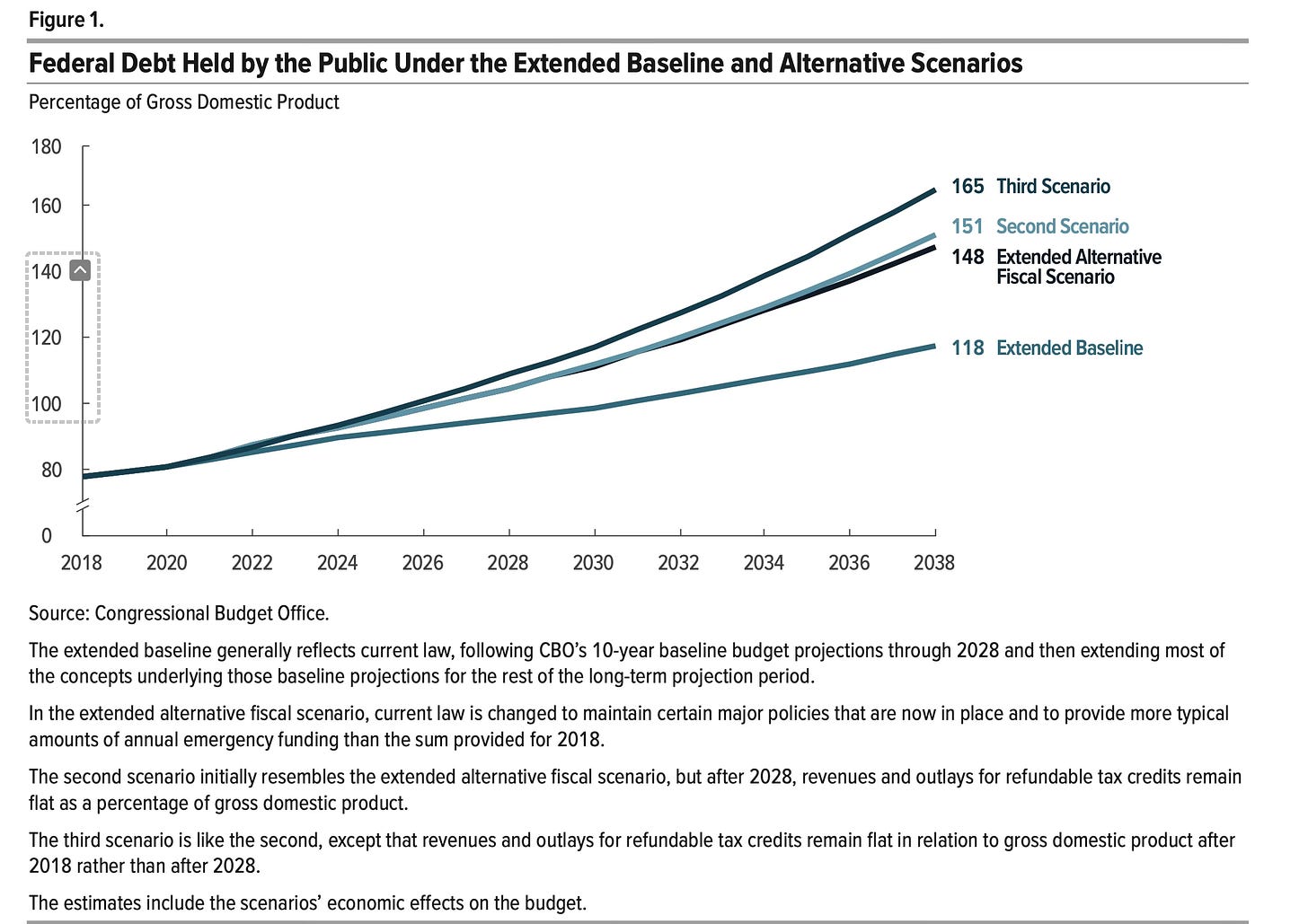

The CBO projections are optimistic, though, in three respects. First, they assume a stable growth path. Any geometric disasters in the growth trajectory, such as what we saw in 2009-2010, would quickly blow-up these numbers. Second, they assume that rates don’t trend up significantly with the increase in debt-to-gdp (though there is a slight feedback in their model). Third, they assume that the Trump tax cuts expire at the end of 2025. This makes a significant difference in the projections, as shown in the CBO Alternative scenario below.

With Trump as President, and a Republican House and Senate, the Trump tax cuts are not likely to expire.

What is likely to happen is that we are going to push the possibilities of deficit finance to their limits. The US government, in other words, has to print to survive, and its ability to do this is threatened if a significant portion of the population stores their money and transacts in bitcoin and other alternative currencies.

My base case has always been that the US government would act against bitcoin in a way that was slow but then haphazard and heavy-handed. This is still my base case. I thought it would happen at 8k or 20k, and now we’re at $87k/bitcoin, but I still think it’s going to happen.

The story has developed a bit of a wrinkle lately. I enjoy The Last Bear Standing on Substack. His Oct 25 post was “Fox in the Henhouse: Implications of a Pro-Bitcoin President.”

The Last Bear Standing points to a recent paper by the Minneapolis Fed called “Unique Implementation of Permanent Primary Deficits.” The abstract of that paper is excerpted below:

“In an economy with incomplete markets and consumers who are sufficiently risk averse, we show that the government can uniquely implement a permanent primary deficit using nominal debt and continuous Markov strategies for primary deficits and payments to debtholders. But this result fails if there are also useless pieces of paper (bitcoin for short) that can be traded. If there is trade in bitcoin, then there is no continuous Markov strategy for the government that leads to unique implementation. Instead, there is a continuum of equilibria with distinct real allocations in which the price of bitcoin converges to zero. And there is a balanced budget trap: continuous government policies designed for a permanent primary deficit cannot eliminate an alternative steady state in which r - g = 0 and the government is forced to balance its budget. A legal prohibition against bitcoin can restore unique implementation of permanent primary deficits, and so can a tax on bitcoin at the rate -(r - g) > 0.”

I put the last sentence in bold for emphasis. The authors find, essentially, that bitcoin is incompatible with deficit finance, and therefore must be confiscated or taxed prohibitively.

The Last Bear Standing presents a nuanced analysis. He argues that the US is not in the simple scenario envisioned by the Minneapolis Fed authors, but rather in a world where btc might leave the US behind as every important countries move to a btc standard first. The Last Bear Standing is excerpted below:

“For developed countries whose currencies serve as a reserve asset, the calculus is more complicated. Growing adoption would threaten their own privilege, weaken their currency, normalize trade imbalances, and disrupt deficit funding mechanisms. They may seek to eliminate the threat by banning or taxing away Bitcoin, as hinted by the papers referenced above. Or, they may attempt to get ahead of the curve, establishing bitcoin reserves of their own either by purchasing coins directly (as proposed by RFK Jr.)or merely stockpiling confiscated coins (as proposed by Trump).

But for such countries, accumulating bitcoin sends a massive negative signal — the equivalent of shorting your own currency. Further, the public acknowledgment of this strategy might accelerate the trend towards a tipping point, one that forces other countries to take note and catch up, hastening the demise of the status quo.”

The Last Bear Standing ends his piece by expressing some skepticism that Trump has any core beliefs around btc, and he notes that, in his view, “the most likely scenario is that Bitcoin sits alongside fiat as a supplemental asset class, similarly to the way gold functions today.”

This is similar to the argument that Ben Hunt has made for several years. Ben Hunt argues that bitcoin has been co-opted into “Bitcoin™”, a clean financial product that is tightly regulated and surveilled. In “Sauron Remains Undefeated,” he writes: “Bitcoin! TM doesn’t stick it to the Man … Bitcoin! TM IS the Man.” link: https://www.epsilontheory.com/sauron-remains-undefeated-2/

This might indeed be the most likely scenario, but it is quite the gamble on the part of governments. It’s a gamble because, unlike gold, bitcoin can be used for transactions, and it’s effortlessly portable, so there’s a real risk that the USD system could be skirted altogether by a segment of the population. That doesn’t square well with the US government finance outlook that we covered above.